Why You Should Consider Coca-Cola or PepsiCo For Your Portfolio in 2025

Warren Buffett’s $776 Million Dividend, Fair Value Insights, and the Ultimate Battle of Beverage Giants for Your Portfolio

Introduction

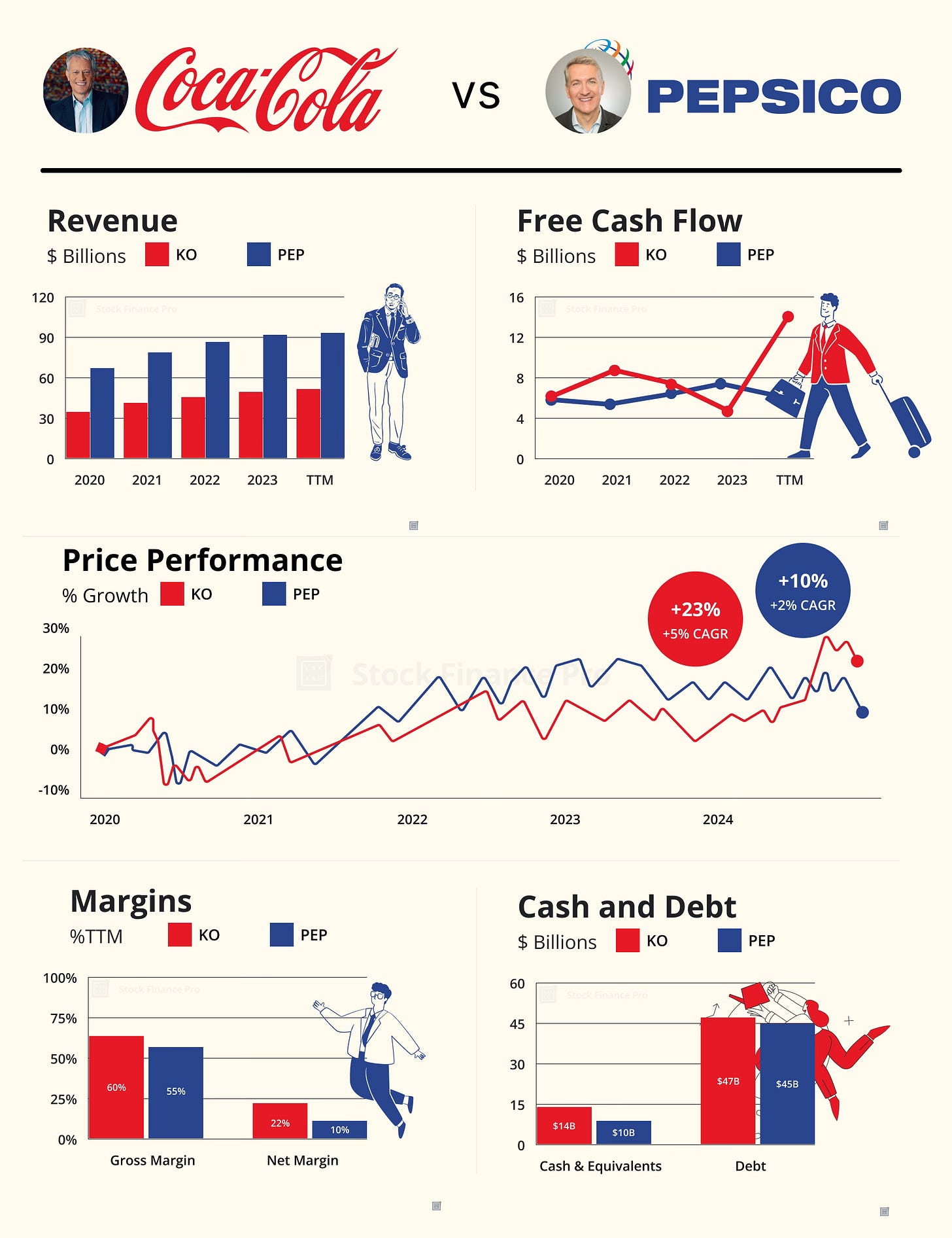

Coca-Cola (NYSE: KO) and PepsiCo (NASDAQ: PEP) are iconic beverage giants with rich histories and a vast portfolio of products. This article compares Coca-Cola and PepsiCo as investment opportunities, considering Warren Buffett's significant annual dividend from Coca-Cola and examining whether these stocks are fairly valued today.

Warren Buffett's Investment

In 1988, legendary investor Warren Buffett, CEO of Berkshire Hathaway, began accumulating shares of the Coca-Cola Company. Recognizing the company's strong brand loyalty, global reach, and consistent earnings, Buffett saw Coca-Cola as a prime example of a durable competitive advantage—or an economic moat.

By the early 1990s, Berkshire Hathaway had invested around $1 billion to acquire a substantial stake in Coca-Cola. This investment has since grown exponentially to around $25 billion. As of 2024, Berkshire Hathaway owns over 400 million shares of Coca-Cola, representing about 9% of the company’s stock portfolio. With Coca-Cola's annual dividend per share at $1.94, Berkshire Hathaway receives around $776 million yearly from this investment alone.

Would Warren Buffett Invest in Coca-Cola Today?

Buffett's investment philosophy centres on buying quality companies at reasonable prices and holding them indefinitely. While he continues to hold his Coca-Cola shares, it is questionable whether he would invest in the company at today's valuations.

Buffett typically seeks undervalued companies with solid fundamentals. Given the current valuation, he might consider Coca-Cola slightly overvalued for new investments. However, the company's strong brand and consistent dividends still make it an attractive option for long-term investors.

Fair Value of Coca-Cola and PepsiCo: Which Is the Better Investment?

Choosing between Coca-Cola and PepsiCo depends on individual investment goals:

Income Investors: Pepsico's higher dividend yield might appeal more to those seeking regular income.

Growth-Oriented Investors: PepsiCo's diversification and growth in the snack segment could offer better long-term growth potential.

Risk Tolerance: Both companies are considered low-risk due to their strong market positions, but PepsiCo's broader product range might provide a slight hedge against market fluctuations.

Let's examine a few financial metrics to determine which company might be the better investment today:

Coca-Cola (NYSE: KO)

Market Capitalization: Approximately $265 billion

Enterprise Value $297 billion

P/E Ratio: 26

Dividend Yield: 3.14%

PepsiCo (NASDAQ: PEP)

Market Capitalization: $217 billion

Enterprise Value: $255 billion

P/E Ratio: Around 23

Dividend Yield: 3.42%

Maximize your investment potential by using this valuation investment tool to accurately assess which current stock price offers a lucrative opportunity. With precise financial modelling, Stock Finance Pro empower you to confidently determine if the company is a strong buy for your investment portfolio.

Using the Ticker Symbol KO or PEP, Stock Finance Pro imports Coca-Cola or PepsiCo’s financial data and instantly provides a fair value. By changing projected growth rates and discount rates in the calculator, you can recalculate the fair value of the company to align with your investment thesis.

Conclusion

Coca-Cola and PepsiCo have proven resilient companies with solid financials and global brand recognition. Warren Buffett's long-term investment in Coca-Cola underscores the potential benefits of investing in well-established companies. However, considering current valuations and growth prospects, PepsiCo's diversified portfolio may offer a slight edge for investors today.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should consult with a financial advisor before making any investment decisions.